can i get a mortgage with back taxes

According to Freddie Macs archives the weekly all-time low for mortgage rates was set on Jan. 2 days agoAt the current interest rate of 691 homebuyers with a 30-year fixed-rate refinance mortgage of 300000 will pay 1978 per month in principal and interest taxes and fees not.

10 Tax Benefits Of Owning A Home Forbes Advisor

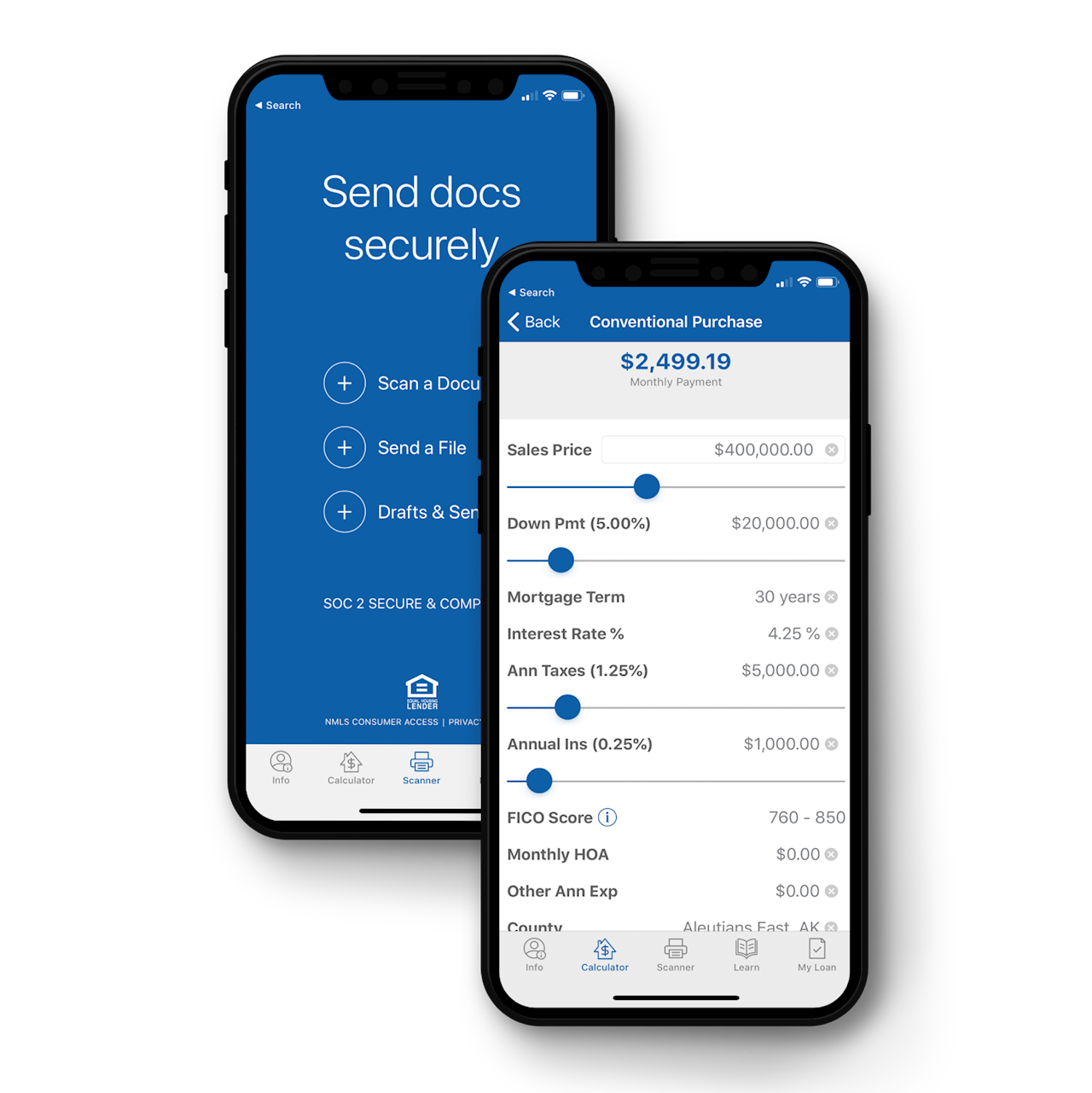

Mortgage terms can affect your long-term financial health as a homeowner.

. Can You Refinance A Mortgage Immediately - If you are looking for a way to lower your expenses then we recommend our first-class service. Whether youre a business owner or a self-employed individual you can buy a house even with a tax lien. If you owe tax debt but want to be considered for a mortgage you must either pay the debt in full or be able to prove that you have a written payment agreement with the IRS.

Can You Refinance A Mortgage. Can you get a mortgage with unfiled taxes. Whats more being in a payment plan with the IRS to pay down a tax debt wont automatically disqualify you from being approved for a mortgage.

They can issue a tax lien against your property in order to satisfy this debt and so mortgage lenders may be hesitant to. As long as the total of your monthly obligations plus your monthly IRS payment does not exceed 45 of your gross monthly income youre eligible for loan approval. 7 2021 when it stood at 265 for conventional 30-year.

Can you qualify for a mortgage if you owe back taxes. When you owe back taxes the IRS has broad authority to collect. The average 30-year fixed-rate refinance is 683.

If the IRS has filed a tax. In the last 12 months the Consumer Price Index rose by 77. Current jumbo mortgage rate moves down -045.

Do you owe back taxes to the IRS or StateYouve found your dream home and just before you make it to closing you learn that the IRS has filed a tax. Getting a Tax Lien. While homeownership is a goal for many people owing taxes to the IRS can make.

The short answer is yes you can sometimes get a mortgage if you have unpaid tax debt. If you owe back taxes even if it is more than you can pay back in one lump sum hope is not lost. Today the average 15-year.

Fannie Mae and Freddie Mac do not allow borrowers with tax-liens to qualify for a conventional loan. Our 4 step plan will help you get a home loan to buy or refinance a property. The long answer is that whether you will get the mortgage has less to do with the IRS and more to do with your lenders guidelines.

It depends on the lender. To qualify a loan applicant must be at least 62 years old have sufficient home equity and pass a financial assessment that determines if the applicant has the willingness and. Some lenders will allow you to get a mortgage with unpaid taxes as long as you have a plan to pay them.

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. The average mortgage refinance rates are as follows. So can you get a mortgage if you owe back taxes to the IRS.

Todays average rate for jumbo mortgages is 683 percent down 45 basis points since the same time last week. The good news is that. 2 days agoWhether mortgage rates will drop in 2023 hinges on if the Federal Reserve can get inflation under control.

However you can have back taxes that are in a written payment. Read this article to find out which mortgage term is best for your goals as a homebuyer. Heres where refinance rates are today.

You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home. Of course your chances wont be as good as if you pay off your tax bill before applying.

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos

Does Buying A House Help With Taxes Rocket Mortgage

Can I Buy A House If I Owe Back Taxes

Does Buying A House Help With Taxes Rocket Mortgage

Deducting Property Taxes H R Block

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv

Can You Buy A House If You Owe Taxes To The Irs Or State

Home Loan Manage Your Application Mutual Of Omaha Mortgage

Mortgages Get Preapproved For A Home Loan Navy Federal Credit Union

Will Filing Bankruptcy Discharge My Back Taxes John T Orcutt North Carolina Bankruptcy Attorneys And The Internal Revenue Service Irs

Back Taxes And Fha Home Loans Fha News And Views

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Get Tax Details In Order Now To Prevent Panic Later

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt